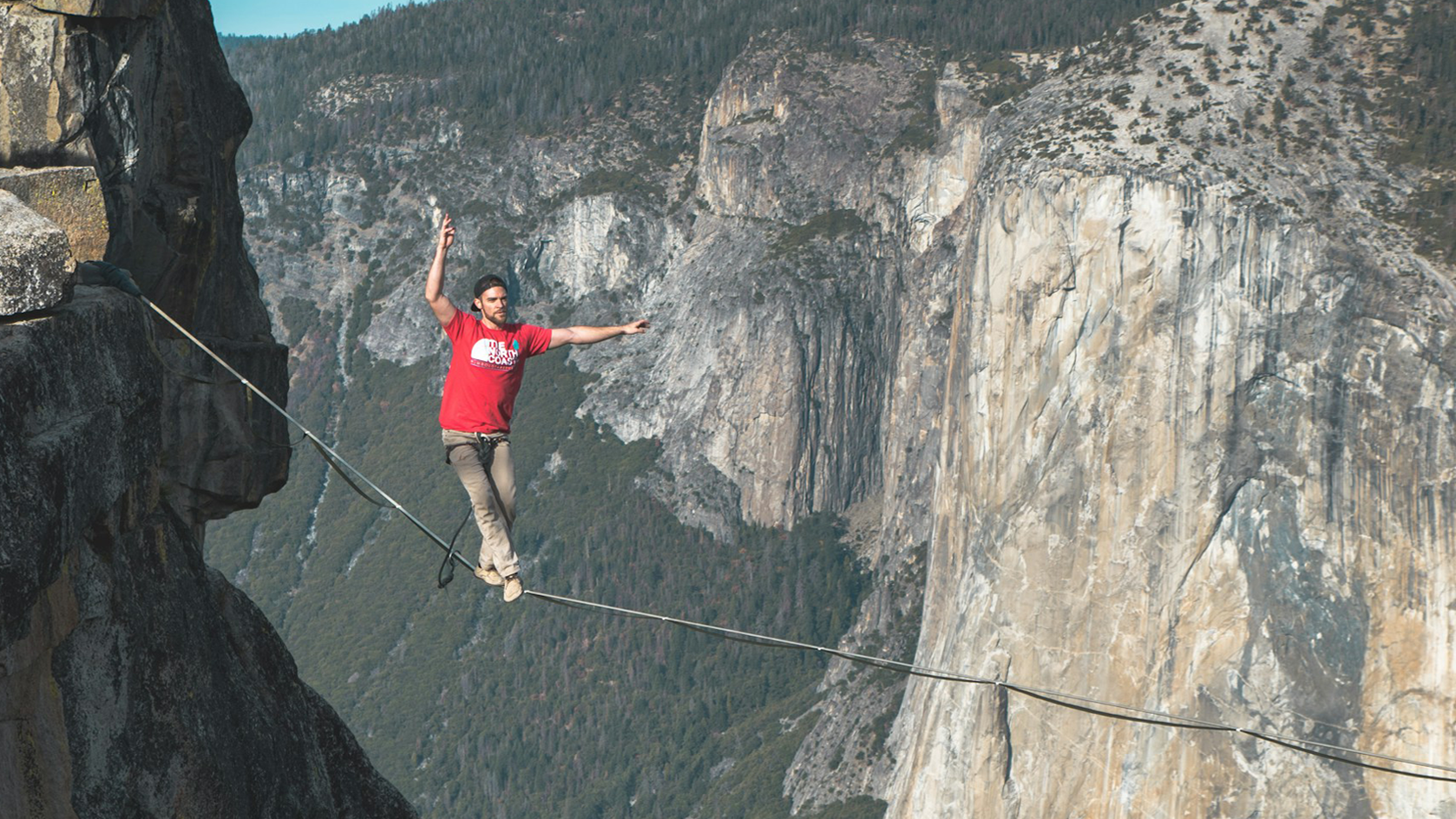

All publicity is good publicity but surely it should be avoided (evaded?) in this case?

Previous blog entries have highlighted the distinction between tax avoidance (legally minimising the tax liabilities) and tax evasion (illegal methods of avoiding tax).

HM Revenue and Customs have recently announced a new weapon in their fight against people who illegally evade tax. The tax authorities have said that people who have committed tax evasion on or after 1 April 2010 will now not only have to settle the tax owed, pay interest on tax and suffer potential penalties but they will now also face the prospect of having their names and addresses put up on the Revenue’s website for everyone to see.

This will apply to people that have deliberately evaded tax of more than £25,000.

There’s a saying that “all publicity is good publicity” but I’m not sure that being publicly exposed as a tax cheat is something that a lot of people will be looking for in terms of good publicity!