Can a “fat finger” really cost USD 800 billion?

It happened so fast, you may have missed it: On 6 May the Dow (stock exchange) index lost 999 points in 15 minutes, the largest intra-day drop in the market’s history. USD 800 billion in share value was wiped out before recovering (in the next 15 minutes) by USD 600 billion.

So what happened? One trader suggested that the decline may have been triggered by a so-called “fat finger” trade, meaning that a transaction may have been entered incorrectly by human input. It was suggested that a “billion” may have been keyed in instead of “million”, with the result that some “big-name” companies, such as Procter & Gamble and 3M, experienced big (but temporary) falls in their share prices.

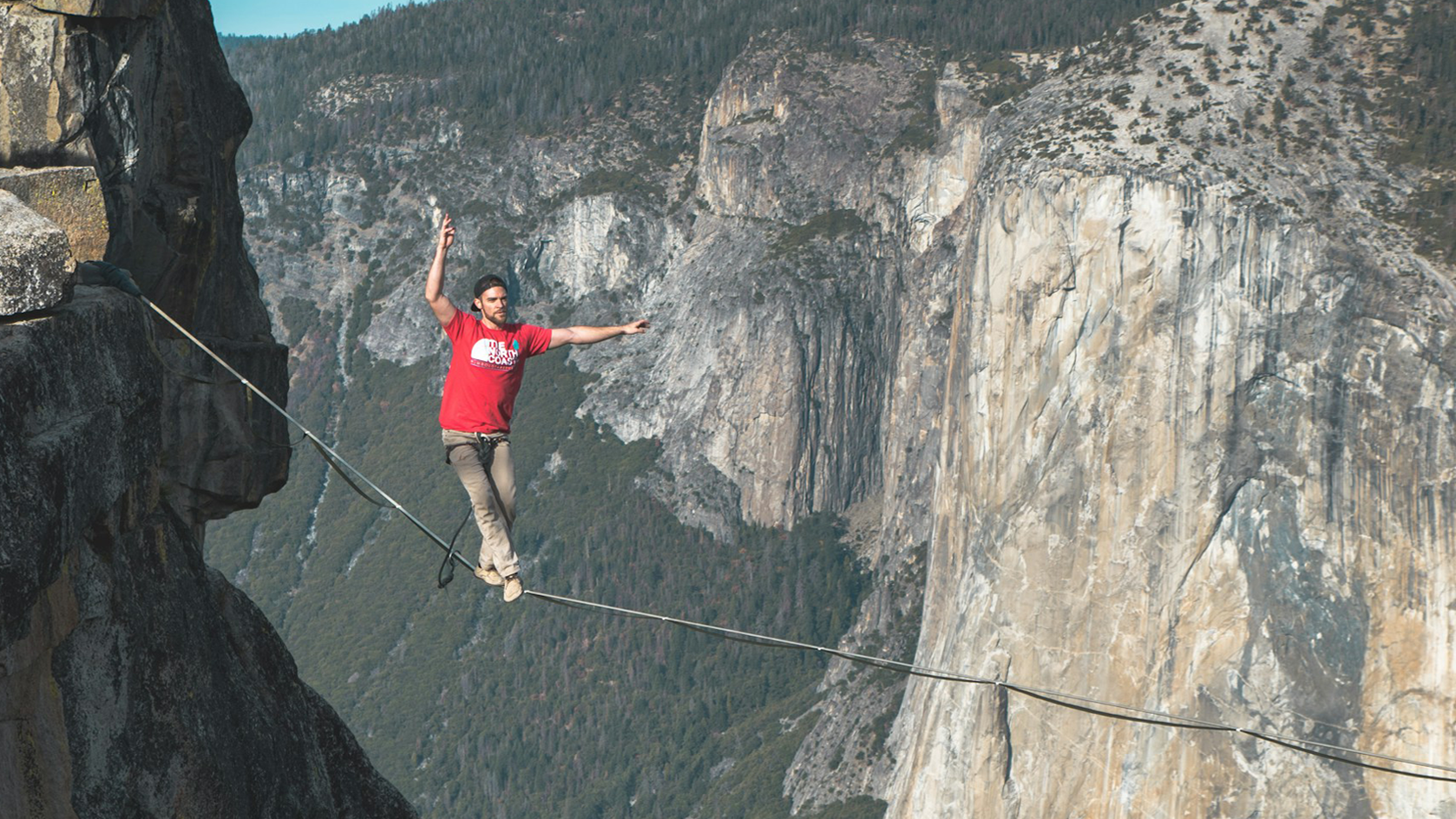

Whatever started the selloff, it was intensified by automated computer trading, which led to a cascade of “sell” orders. The authorities are checking whether exchange “circuit-breakers” worked properly (these are procedures to halt trading temporarily if prices drop too sharply). System safeguards may have to be tightened in order to protect markets which are already very nervous because of the Greek debt crisis.

So was it simply “human” error? A case of “operational” risk? Whatever the conclusions, it is clear that this event will prompt a re-examination of the markets from financial, regulatory and technological points of view.