Who earns the most out of the Top Gear presenters?

BBC Worldwide has just published its latest annual report and for any fans of the TV programme Top Gear there are some interesting figures.

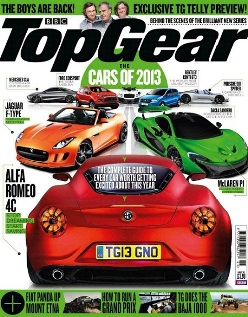

Top Gear is an incredibly successful TV programme. The programme which is so loved by car addicts around the world is the world’s most widely watched factual television programme and is shown in 174 territories. That’s pretty impressive and shows what a global success the programme has become.

It stars Jeremy Clarkson, Richard Hammond (the Hamster) and James May (Captain Slow) but who earns the most out of the 3 presenters?

It will probably come as no real surprise to find out that Jeremy Clarkson received the most last year.

Interestingly though the majority wasn’t from his salary but rather from dividends and a sale of shares.

5 years ago a company called Bedder 6 was set up with the aim to exploit the commercial opportunities of the Top Gear brand.

Top Gear Magazines, live shows and DVDs followed.

So who were the original shareholders of Bedder 6 when it was set up?

Well, the BBC was a 50% shareholder whilst Top Gear executive producer Andy Wilman had a 20% stake and Jeremy Clarkson had a 30% shareholding.

Alas for poor Hamster and Captain Slow the other 2 presenters didn’t hold any shares.

The recently released BBC accounts show that the BBC bought out the shareholdings of Clarkson and Wilman.

How much did Clarkson receive in total from the BBC last year?

He received a salary of £1 million, dividends of £4.86 million from Bedder 6 and £8.4 million for selling his shares in Bedder 6 to the BBC.

In total, he received £14 million from the BBC.

That’s not a bad amount is it?

To be fair to the guy though he’s been instrumental in building the Top Gear brand into a global success with millions of viewers around the world so arguably he deserves the financial rewards that go with it.

With that amount of money hitting his bank account in the last year though one thing he can definitely do is to buy any car that he wants.