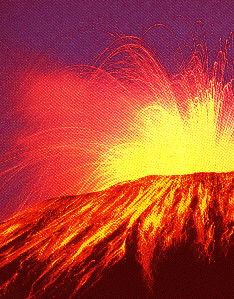

You may recognise this volcano but what about recognising the revenue?

It seems that a certain volcano in Iceland is going off again.

At the time of writing, a number of UK airports have had to close because of drifting volcanic ash. This, it seems, is likely to be an ongoing problem, especially for more northern European countries.

I have a flight booked in a couple of weeks’ time. I am innately cost conscious and so booked a non-refundable, non-changeable ticket.

Under the Framework definition of an asset and a liability, the airline has received my money and the only obligation that they have is to incur the marginal costs of flying me there, which are likely to be fairly small. Using the logic of the Framework therefore (and the probable logic of the new accounting standard on revenue recognition that is likely to come through in a couple of years’ time), they would be able to book revenue at the time that the sale was made.

Under the approach of the extant accounting standard IAS 18, however, revenue can only be recognised when the service is provided. This means that none of my cash is currently in the airline’s profit or loss.

That approach has always seemed excessively prudent to me, as the chances of having to refund the money to the customer has always seemed remote. I’ve long believed that IAS 18 is in need of replacement with something that focuses more accurately on assets and liabilities.

Mount Eyjafjallajokull has made me wonder whether perhaps holding all revenue in deferred revenue as a liability until it’s sure that it’s no longer a liability might not be such a bad idea after all….